Payment for sick leave for child care is provided for by Law No. 255-FZ. How many days can an employee take care of a sick child? How is a sick leave issued if an employee has several sick children? How to properly pay for sick leave for child care, taking into account the latest changes in legislation? We will tell you in the material further.

Disability allowance for child care before 7 years

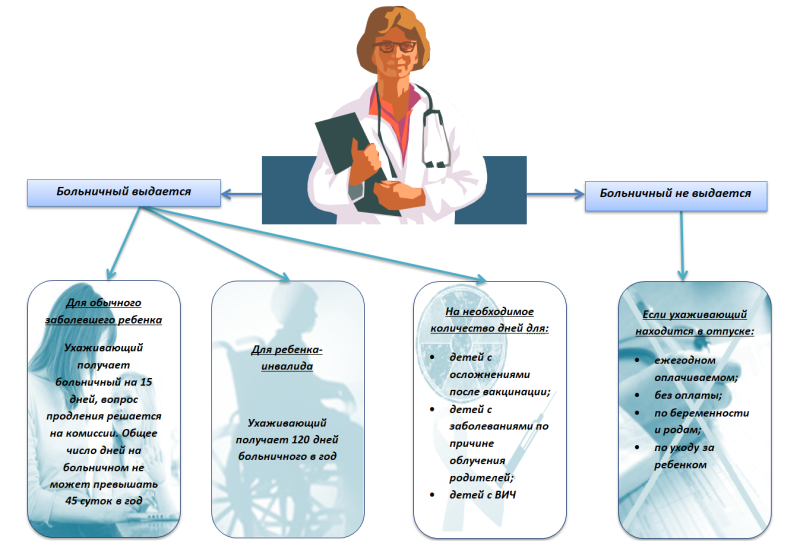

Sick leave for the care of a child under 15 years old is issued for the entire period of treatment (paragraph 44 of the Procedure for issuing and processing disability certificates, approvedby Order of the Ministry of Health dated November 23, 2021 No. 1089n).

The disability allowance for caring for a child under 7 years of age is paid to any of the relatives who take care of a sick child. At the same time, only payments are made:

- 60 calendar days per year;

- 90 calendar days per year for the treatment of severe diseases from the closed list of the Ministry of Health.

Who and for how long is entitled to receive sick leave for the care of a child from 7 to 15 years old

Any of the parents, relatives or guardians caring for a child of 7 years up to the age of 15 can also receive sick leave for the care of a child for the sick person. Such a sick leave is also issued without time limits (paragraph 44 of the Procedure for issuing and registering a medical certificate), and is paid (paragraph 2 of part 5 of Article 6 of the Law of December 29, 2006 No. 255-FZ):

- up to 15 calendar days for each case of care;

- no more than 45 calendar days in a calendar year for all cases of child care.

In which case a sick leave for child care is not required

The bulletin is not issued if the caregiver is on vacation:

- annual paid (extension of the rest period is possible only if the employee is ill);

- without payment;

- maternity leave.

Students and unemployed parents will not receive it either.

If several children are ill, how is sick leave issued for each child

If an employee has two children sick at the same time, one electronic certificate for their care is issued. In the case of caring for two children who are sick at the same time by different persons, each of the caregivers is given a disability certificate.

In case of illness of the second (third) child during the illness of the first child, the BL previously issued for the second child is extended until all children recover, without counting the days that coincided with the days of release from work to care for the first child.

Such rules are prescribed in paragraphs 47, 48 of the Procedure for the issuance and registration of personal identification documents.

Ballots may be issued to several related persons in turn, subject to the following condition: 1 sick leave for 1 caregiver.

How to pay for sick leave for child care

If the child is 8 years old or older, the calculation rules remain the same.

The amount of the allowance for caring for a sick child of 8 years and older who received treatment in a hospital depends on the length of service of the caregiver and is calculated as a percentage of average earnings:

|

Experience (years) |

% of NW |

|

8 and more |

100 |

|

5 to 8 |

80 |

|

Up to 5 |

60 |

How to calculate the length of service for sick leave, read here.

If the child’s therapy was carried out at home, then the first 10 days are paid to the caregiver depending on the length of service, the subsequent days of illness are in the amount of ½ from the NW.

ATTENTION! Starting from 2021, the payment of children’s sick leave from day 1 is made directly by the SFR (until 2023 – by the FSS). The employer does not calculate the benefit and does not pay anything, but only sends to the fund the documents necessary for calculating and paying the benefit (paragraph 3 of Article 3 of the Law on Compulsory Social Insurance…”dated 12/29/2006 No.255-FZ).

How children’s sick leave is calculated and paid in 2024

Until 2021, the employer calculated and paid the allowance, and then he applied for reimbursement to the Federal Tax Service.

Since 2023, the payment of sick leave is carried out by the Social Fund of Russia (until 2023 – FSS) directly to the employee. Recall that the payment is made in a proactive mode, i.e. the fund sends the pre-filled register to the employer via the TCS. The employer fills in the necessary lines and sends the register to the Fund. The inspectors make the payment after the inspection. Here is an algorithm and an example of calculating the allowance.

Example

Employee Kotova A.M. provided a bulletin on the care of a child of 8 years old on an outpatient basis from 02/01/2024 to 02/10/2024 (10 calendar days). The experience of the employee is 16 years. Earnings for the last 2 years – 948,000 rubles. There were no sick days during this period.

To calculate the benefit amount, you must:

- Calculate the average daily earnings:

948,000/730 = 1,298.63 rubles. – the result should be compared with the minimum and maximum of 2024.

- Calculate the amount of the allowance for the days of the child’s illness, taking into account the percentage of work experience:

1,298.63 × 10 = 12,986.30 rubles

The total amount of the benefit will be 12 986.30 rubles. The SFR will transfer it minus personal income tax to the details of the employee’s bank account.

Previously, if an employee with children got a job at a company not since the beginning of the year, the new employer could not know how many days he was on sick leave for caring for a child during years before employment. The FSS did not oblige the employer to find out this data. But the policyholder was responsible for the correctness of the calculation and expenditure of social insurance funds (clause 10 of the Regulations on the Social Insurance Fund of the Russian Federation, approved by the Decree of the Government of the Russian Federation dated 02/12/1994 101). Consequently, if the social security service revealed that the employee was paid more days than he should have been for the year, he could refuse to offset the overpaid funds. In connection with these employers, it was recommended to request from the employee a certificate from the previous place of work about the number of days used for caring for a sick child (letter from the Federal Tax Service dated 06/24/2016 No.02-11-09/15-05-128OP). Currently, the SFR has sufficient information to determine the number of paid sick days.

Results

Sick leave for child care from 2021 is paid by the SFR (until 2023 – FSS) directly to the employee. No calculations are required from the employer, but only documents are required on the basis of which the allowance will be calculated and paid by the SFR.

For more information about the rules for calculating benefits, see our section “Benefits”.

Do you want to get a qualified answer to your question as soon as possible? Then take a look at our forum or ask the experts and colleagues in the VKontakte group.