Financial assistance at the birth of a child from the employer is paid only at the request of the head of the organization. The legislator does not oblige him to do this. In the article we will tell you in which cases an employee can receive such a payment and what needs to be done to issue it.

Financial assistance at the birth of a child

The obligations of the employer do not include payment of financial assistance at the birth of a child. The employer may decide to provide employees with this type of social support on their own. The conditions and procedure for payment of financial assistance, as well as its amount, are established by an employment or collective agreement or a local regulatory act (Articles 8, 41, 57 of the Labor Code of the Russian Federation).

In contrast to payments for the employer’s funds, financial assistance at the birth of a child from the state is paid to all young parents. However, it is called differently — «lump sum allowance at the birth of a child ».

Working citizens make this payment through the employer, but since 2021, the FSS pays them money directly (from 01.01.2023 – SFR). From 01.02.2024, the amount of payment is 24,604.30 rubles. Only one parent has the right to receive payments, and the second one will have to provide a certificate stating that he did not receive such benefits at his place of work.

Is financial assistance provided to both parents?

Financial assistance at the birth of a child is paid by the employer only if the provision of this type of social support is provided for by internal documents. Payments are provided at the expense of the company’s own funds, most often from the retained earnings fund, so it does not matter to the employer whether the second parent working in another organization received such assistance.

Nuances in the payment of money may arise if both parents of a newborn child work in the same organization. In these circumstances, it is also necessary to be guided by the provisions of a collective agreement or other document defining the procedure for granting payments. If it explicitly states that only one parent can receive assistance, only the mother or father of the child will be able to apply for payment. If there are no such instructions in the contract, both parents can apply.

Registration of assistance

As a rule, for registration of one-time financial assistance in connection with the birth of a child at the place of work, it is required to submit:

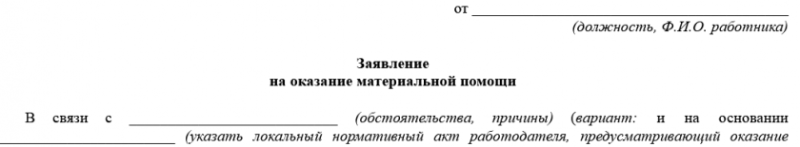

- an application for the payment of funds; it is drawn up in any form;

- a copy of the birth certificate of the child.

The amount of payment assigned to an employee at the birth of a child is set by the employer. Financial assistance is paid in a fixed amount established by the provisions of the collective agreement, or is determined by the management individually in each specific case, it all depends on the financial condition of the enterprise and the content of internal documents regulating the payment procedure.

Application for payment

The application form has not been established at the legislative level, therefore it is drawn up in a free form.

The main thing is to specify:

- Full name of the director;

- name of the company;

- Full name of the employee submitting the application;

- name of the department in which the employee works;

- content of the request (to pay financial assistance in connection with the birth of a child in accordance with the provisions of an employment or collective agreement or other local document);

- details of the birth certificate;

- date of compilation the document.

The application is signed by the employee submitting it, the immediate supervisor and the person whose authority includes the distribution of funds (most often such decisions are made by the general director of the enterprise). You can download the form and a sample of such an application for free by clicking on the picture below:

Application form for payment of financial assistance

After all signatures are collected, the application is sent to the HR department. On its basis, an order is drawn up for the payment of financial assistance. The order is sent to the accounting department, after which money is transferred to the employee’s current account.

What state payments can be received at the birth of a child, we wrote in the articles:

- “Regional payments at the birth of a child”;

- “Presidential payments at the birth of a child”.

Results

So, financial assistance from the employer is provided to the employee at the birth of his child only if this type of social support is provided by a collective agreement or other local regulatory act in force at the enterprise. It is not necessary to confuse assistance from an employer with a one-time allowance for the birth of a child, which is paid by the employer, but not on their own, but at the expense of the SFR funds.